Read Time: 5 Minutes Subscribe & Share

A Different Party

Wars have unintended consequences, as anyone who reads Heather Cox Richardson obsessively will be able to appreciate. In 1764 the British levied a series of taxes (stamp acts) on the colonies to help pay for their costly victory over France in the Seven Years War (also called the French and Indian War). Under the Treaty of Paris, a huge piece of New World real estate, which included all French territory east of the Mississippi River and Spanish holdings in Florida (Cuba was returned to Spanish rule), required a vastly increased British military presence and expense. The Sugar Act successfully enforced taxes on sugar and molasses coming into the colonies from non-British sources in the Caribbean sugar plantations. Rum (which is basically distilled sugarcane molasses or juice) was a huge industry in the colonies – even George Washington dispensed it at campaign parties to win over voters, according to the Mount Vernon website. It can be argued that although complex in how it was produced, exported and desired, sugar – and not tea – sparked a world-changing revolution.

Wars have unintended consequences, as anyone who reads Heather Cox Richardson obsessively will be able to appreciate. In 1764 the British levied a series of taxes (stamp acts) on the colonies to help pay for their costly victory over France in the Seven Years War (also called the French and Indian War). Under the Treaty of Paris, a huge piece of New World real estate, which included all French territory east of the Mississippi River and Spanish holdings in Florida (Cuba was returned to Spanish rule), required a vastly increased British military presence and expense. The Sugar Act successfully enforced taxes on sugar and molasses coming into the colonies from non-British sources in the Caribbean sugar plantations. Rum (which is basically distilled sugarcane molasses or juice) was a huge industry in the colonies – even George Washington dispensed it at campaign parties to win over voters, according to the Mount Vernon website. It can be argued that although complex in how it was produced, exported and desired, sugar – and not tea – sparked a world-changing revolution.

The Sugar In Us

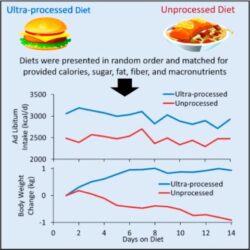

As a baker and someone who follows the dictum of Eat Dessert First, I was not surprised to find out that the US is a world leader in per capita sugar consumption, clocking 126.4 grams daily. I try to do my part. Unfortunately the recommended amount daily for women is a measly 26 grams (6.5 teaspoons) and for men 36 grams. (9 teaspoons). We certainly have had it drummed into our brains that the prevailing levels of sugar consumption in the US are responsible for dramatic increases in obesity, diabetes and heart disease. For a nation that has more Pilates and yoga studios than drycleaners, these serious health conditions would seem improbable.

Sometime in the latter part of the 1950s, the nutritional science community and the general public became obsessed with theories that low-fat diets would lead to a heart-healthy population. Extensive and somewhat inconclusive testing on fats and the state of public health continued throughout the following decades. Food manufacturers plugged into this and removed fats from processed foods, bolstering those moves with lots of PR campaigns. But to make the revised products more palatable (fats carry flavor), more sugar was added – so was salt, but that is another issue. We now have supermarkets, gas stations, convenience stores, fast food franchises all offering at enticing prices, foods that have an astonishing amount of sugar added to the mix. And the drink industry is responsible for almost half of the added sugar in US diets according to our NIH.

public became obsessed with theories that low-fat diets would lead to a heart-healthy population. Extensive and somewhat inconclusive testing on fats and the state of public health continued throughout the following decades. Food manufacturers plugged into this and removed fats from processed foods, bolstering those moves with lots of PR campaigns. But to make the revised products more palatable (fats carry flavor), more sugar was added – so was salt, but that is another issue. We now have supermarkets, gas stations, convenience stores, fast food franchises all offering at enticing prices, foods that have an astonishing amount of sugar added to the mix. And the drink industry is responsible for almost half of the added sugar in US diets according to our NIH.

Rather than readjusting our food products so that they are healthier, we have devised medications, apps and exercise studios to undo the damage. Food manufacturers see no reason to change formulations that are so profitable, and we now have a complementary weight reduction industry that is comfortable with the status quo. If, as a nation we cannot rely on an industry to self-regulate, why not leverage a tax on the foods that are making a substantial part of our population sick? So far, while there has been some lackluster debate in Congress, but no action, several cities have levied a very small tax on sugary drinks. With at least a penny tax per ounce, the following cities – Boulder, CO; Philadelphia, PA; Oakland and San Francisco, CA; and Seattle, WA have lowered the retail sales of the targeted drinks by 33%. This tax generally was attached to sugar-sweetened sodas including “diet” sodas, coffee and tea drinks, fruit drinks and, ironically, energy and sports drinks, There has been no health assessment yet made on the affected populations, but all cities report a substantial reduction in SSB (the current acronym for sugar-sweetened beverages) purchases and a nice increase in tax revenues, which I hope goes to public health services.

Tax And Desist

So what happens when a country decides to tax the producers of added sugar products? Several countries report positive results. So far, Mexico, South Africa, Barbados, The Bahamas, and Britain have provided positive data-backed outcomes, As with most food related issues, the populations that suffer the most are ones where poverty levels are high. In the case of Britain, records show that over the past five years, their tax on SSB has lowered the purchases of these drinks by a third. The design of Britain’s Soft Drink Industry Levy has forced companies to lower their sugar formulations in the products they sell. In one study of the levy, over 45,000 tons of sugar have been removed from the targeted drinks since the legislation passed. The most astonishing statistic for me was that the obesity level among 11- and 12-year-old girls dropped substantially. The tiered levy on sugared drinks was paired with regulations limiting visibility of these products in grocery stores and also in advertising.

So what happens when a country decides to tax the producers of added sugar products? Several countries report positive results. So far, Mexico, South Africa, Barbados, The Bahamas, and Britain have provided positive data-backed outcomes, As with most food related issues, the populations that suffer the most are ones where poverty levels are high. In the case of Britain, records show that over the past five years, their tax on SSB has lowered the purchases of these drinks by a third. The design of Britain’s Soft Drink Industry Levy has forced companies to lower their sugar formulations in the products they sell. In one study of the levy, over 45,000 tons of sugar have been removed from the targeted drinks since the legislation passed. The most astonishing statistic for me was that the obesity level among 11- and 12-year-old girls dropped substantially. The tiered levy on sugared drinks was paired with regulations limiting visibility of these products in grocery stores and also in advertising.

Both my daughters have remarked on the number of obese people they notice when they have returned to the US. I have spotted the same in airports when planes disgorge predominantly American passengers. I also found it shocking that an increasing number of children in the US are undergoing gastric bypass surgery, so much so that the American Academy of Pediatrics has set guidelines. Clearly, national awareness initiatives set by the White House aren’t working, and the industries creating this health crisis are not willing to self-regulate. Rather than providing drugs and surgeries to alleviate these serious health issues, we need stiffer regulations and taxation on the manufacturers to remove the problem. Maybe the British sugar tax this time will birth a different revolution.

Kitchen Detail shares under the radar recipes, explores the art of cooking, the stories behind food, and the tools that bring it all together, while uncovering the social, political, and environmental truths that shape our culinary world.

Oh, good. Another way to solve problems via taxation.